The Federal Republic of Nigeria has acceded to the Establishment Agreement for the Fund for Export Development in Africa (FEDA), the development impact investment platform of the African Export-Import Bank (Afreximbank).

Nigeria joins the ranks of countries acceding to the Establishment Agreement of FEDA, becoming the 16th nation to do so. This underscores the increasing backing the Fund enjoys among African nations.

This announcement comes three decades following Afreximbank’s establishment in Nigeria, a key milestone that boldly demonstrates Nigeria’s continued commitment to supporting Afreximbank and FEDA’s missions.

FEDA sees new memberships as critical to broadening its scope of interventions and its mission of delivering long-term capital to African economies, with a focus on industrialization, intra-African trade and value-added exports.

The signing of the FEDA Establishment Agreement is expected to pave the way for the ratification of the Agreement in due course. This will in turn bolster FEDA’s interventions in Nigeria.

Professor Benedict Oramah, President of Afreximbank and Chairman of the Boards of both Afreximbank and FEDA, commented: “We extend our sincere appreciation to the Federal Republic of Nigeria for the signing of the FEDA Establishment Agreement. This significant achievement further strengthens the already robust partnership between Afreximbank and Nigeria, one of the Bank’s foremost supporters.

The partnership will enhance investments in sectors critical to the development journey of Nigeria.”

Other countries who have acceded to FEDA’s Establishment Agreement include Rwanda, Mauritania, Guinea, Togo, South Sudan, Zimbabwe, Kenya, Chad, Republic of the Congo, Gabon, Sierra Leone, São Tomé and Príncipe, Equatorial Guinea, Ghana and Egypt.

The Fund for Export Development in Africa (“FEDA”) is the impact investment subsidiary of Afreximbank set up to provide equity, quasi-equity, and debt capital to finance the multi-billion-dollar funding gap (particularly in equity) needed to transform the Trade sector in Africa.

FEDA pursues a multi-sector investment strategy along the intra-African trade, value-added export development, and manufacturing value chain which includes financial services, technology, consumer and retail goods, manufacturing, transport & logistics, agribusiness, as well as ancillary trade enabling infrastructure such as industrial parks.

African Export-Import Bank (Afreximbank) is a Pan-African multilateral financial institution mandated to finance and promote intra-and extra-African trade.

For 30 years, the Bank has been deploying innovative structures to deliver financing solutions that support the transformation of the structure of Africa’s trade, accelerating industrialization and intra-regional trade, thereby boosting economic expansion in Africa.

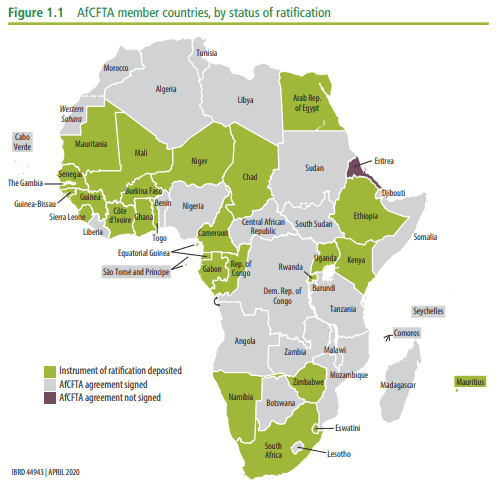

A stalwart supporter of the African Continental Free Trade Agreement (AfCFTA), Afreximbank has launched a Pan-African Payment and Settlement System (PAPSS) that was adopted by the African Union (AU) as the payment and settlement platform to underpin the implementation of the AfCFTA. Working with the AfCFTA Secretariat and the AU, the Bank is setting up a US$10 billion Adjustment Fund to support countries to effectively participate in the AfCFTA.

At the end of December 2023, Afreximbank’s total assets and guarantees stood at over US$37.3 billion, and its shareholder funds amounted to US$6.1 billion.

The Bank disbursed more than US$104 billion between 2016 and 2023. Afreximbank has investment grade ratings assigned by GCR (international scale) (A), Moody’s (Baa1), Japan Credit Rating Agency (JCR) (A-) and Fitch (BBB).

Afreximbank has evolved into a group entity comprising the Bank, its impact fund subsidiary called the Fund for Export Development Africa (FEDA), and its insurance management subsidiary, AfrexInsure, (together, “the Group”). The Bank is headquartered in Cairo, Egypt.